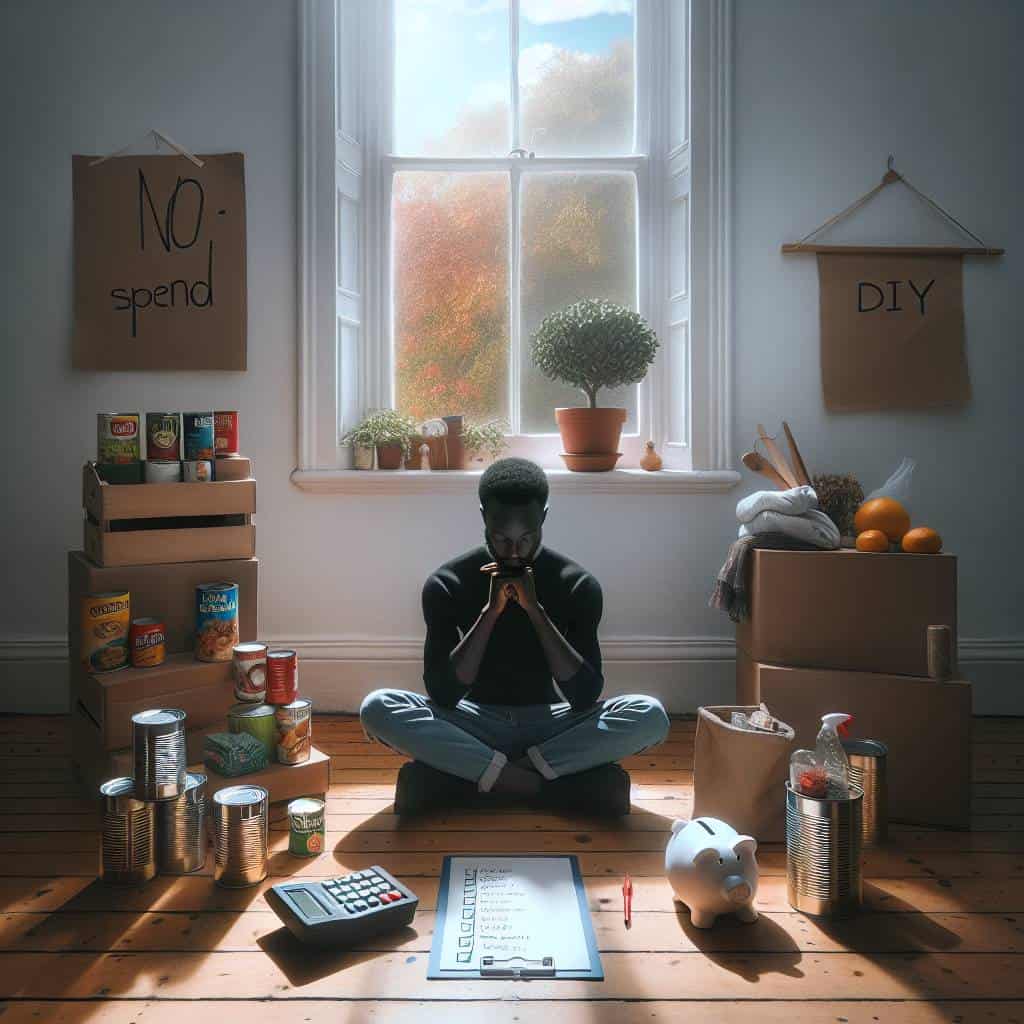

I once tried a no-spend challenge, and let me tell you, it was like living in a sitcom where the joke was always on me. Day one, I was a financial monk, solemnly swearing off lattes and promising to shop my pantry. By day three, I was eyeing my credit card like it was the last lifeboat on the Titanic. Turns out, my resolve was about as sturdy as a wet paper bag. But here’s the thing—failing spectacularly taught me more than any smug success story ever could. I learned that the essence of a no-spend challenge isn’t about deprivation; it’s about creativity and resourcefulness, two things I clearly needed in spades.

So, what can you expect from this little journey through my financial follies? I’m stripping away the usual platitudes and digging into the gritty truth of how to pull off a no-spend challenge without spiraling into existential dread. We’ll tackle the so-called rules that are more like suggestions, explore free activities that don’t feel like punishment, and discuss tracking progress in a way that doesn’t make you want to hurl your spreadsheet out the window. Ready to dive in? Let’s get real about saving money without losing your mind.

Table of Contents

- The Art of Spending Nothing: Crafting Your No-Spend Saga

- Setting the Stage: Rules That Won’t Make You Cry

- Finding Freedom in Free: Activities that Cost Zilch

- Why Embracing Financial FOMO Is Your Ticket To Freedom

- The Brutal Truths About Surviving a No-Spend Challenge

- The Brutal Truth About Spending Nothing

- No-Spend Challenge: Navigating the Tightrope Without a Safety Net

- The Real Cost of Going Zero

The Art of Spending Nothing: Crafting Your No-Spend Saga

Why would anyone want to pretend to be broke for a month? It’s the question I asked myself before embarking on my first no-spend challenge, and let me tell you, the answers are far from the feel-good nonsense you’ll find in self-help books. The art of spending nothing is about more than just frugality. It’s a rebellion against the consumerist gag they try to shove down our throats. You’re setting up your own rules here, not to follow them religiously, but to see how they make you squirm. You’ll lay down the law: no buying anything except essentials. But the real trick? Defining what ‘essential’ means. Spoiler: lattes and impulse Amazon buys don’t cut it.

Now, let’s talk strategy, because flying blind won’t do. You need a plan that’s more than just a list of things not to buy. It’s about filling the void with free activities—things that don’t suck the life out of your wallet. Discover the thrill of library visits, park picnics, or even a good old-fashioned walk. But here’s the kicker: tracking your progress is essential. Not for some self-congratulatory pat on the back, but to witness your transformation. It’s a gritty process that will reveal where your motivations lie. Are you doing this to save money or to prove a point? Either way, the journey will be the tale you’ll tell—the no-spend saga that was more about gaining perspective than about hoarding dollar bills.

Setting the Stage: Rules That Won’t Make You Cry

Alright, let’s get real here. The idea of setting rules for a no-spend month sounds about as thrilling as watching paint dry. But here’s the kicker—without them, you’re just a ship without a rudder, drifting towards the next Amazon flash sale. So, let’s craft rules that won’t have you sobbing into your ramen. Start with the basics: identify your ‘must-haves’ like rent, utilities, and the occasional coffee that keeps you from turning into a complete zombie. Then, figure out your ‘can-live-withouts’—the stuff you buy because, hey, it’s Tuesday and why not? These are the lines in the sand you draw, not to punish yourself, but to illuminate your spending habits like a spotlight on that sneaky impulse-buy monster.

Now, let’s talk about the elephant in the room—how do you keep yourself entertained during a no-spend challenge without losing your sanity? Sure, you could try meditating or reading that dusty book on your shelf, but let’s be real: sometimes you just want a little human connection. Enter the world of online chatting. Specifically, if you’re in Hessen and looking to spice things up, there’s no better way to meet intriguing people than with sex hessen. It’s like window shopping for companionship, minus the spending, and a great way to keep your social life alive without breaking the bank.

Now, don’t get it twisted—this isn’t about deprivation. It’s about clarity. You need rules that feel more like gentle nudges than iron shackles. For instance, allow yourself one small indulgence a week. Maybe it’s that artisanal donut that costs more than a gallon of gas. The point is to give yourself a moment of joy so you don’t end up resenting this whole exercise. Remember, the goal isn’t to live like a hermit; it’s to understand where your money goes and take back control. So, go ahead, set those rules, but make them work for you, not against you.

Finding Freedom in Free: Activities that Cost Zilch

Let’s face it: the best things in life really are free—if you know where to look. We’ve been sold the lie that enjoyment comes with a price tag. But here’s the unvarnished truth: some of the most liberating experiences cost zilch. Take a walk in the park, for instance. Sounds mundane, right? But when was the last time you actually stopped to watch the leaves dance in the wind or the clouds morph into fantastical shapes? Nature doesn’t charge admission, yet it offers a front-row seat to a show that beats any overpriced blockbuster.

And then there’s the art of doing nothing. Yes, I said it, doing nothing. It’s an activity that’s become a lost art in our hyper-scheduled lives. Sit on your porch with a cup of whatever’s in your cupboard, breathe, and let your mind wander. You’d be surprised where it might take you. Or dive into that stack of books you bought but never read because, apparently, you were too busy earning money to buy more books you wouldn’t read. The irony is palpable, isn’t it? All these activities, devoid of cost, yet rich in value. They offer freedom from the relentless chase for more, and isn’t that the ultimate luxury?

Why Embracing Financial FOMO Is Your Ticket To Freedom

- Forget the spreadsheets—start by setting a brutally honest rule: if it’s not keeping you alive or genuinely making you happy, it’s off the table.

- Scour your local area for free activities like a pirate on a treasure hunt; you might just stumble onto something more valuable than your last Amazon binge.

- Keep a journal of your progress, but not the kind you’re thinking—note down every time you almost caved and why, because the real gold lies in those near-misses.

- Motivation is a fickle beast, so forget relying on it; instead, find a sidekick who’s also doing the challenge to call you out when you start eyeing that overpriced latte.

- Track your savings but not obsessively—check in once a week and let the numbers surprise you; the less you look, the more they’ll grow.

The Brutal Truths About Surviving a No-Spend Challenge

Set Your Limits, Then Break Them: Rules are more like guidelines, really. Sure, decide which luxuries to cut, but know that life’s going to test your resolve. When you inevitably slip, don’t beat yourself up—learn from it.

Embrace the Boredom: Finding free activities is less about discovering hidden gems and more about rediscovering how to be content with less. Spoiler: It’s going to be boring at times, and that’s okay.

Track Your Progress with Brutal Honesty: Forget those fancy apps with pie charts. Use a notebook. Write down every penny you don’t spend. It’s not about the numbers; it’s about facing your financial habits head-on.

The Brutal Truth About Spending Nothing

Taking on a no-spend challenge is like trying to run a marathon on a treadmill; you’re going nowhere fast unless you find joy in the free stuff around you. Track your progress like a hawk, but remember, motivation is the only currency you need.

No-Spend Challenge: Navigating the Tightrope Without a Safety Net

How do I even begin setting rules for a no-spend challenge?

Start by acknowledging that rules are just guidelines you’ll probably bend. Decide on needs vs. wants, but remember, coffee might be a ‘need’ when the caffeine withdrawal kicks in.

What free activities can keep me entertained during this frugal escapade?

Rediscover the art of doing nothing. Or better yet, explore your neighborhood trails, binge old classics on your dusty bookshelf, or finally call that friend you always ‘like’ but never talk to.

How can I track my progress without losing my mind?

Keep it simple. A spreadsheet or a journal works if you’re into that sort of thing. If not, just check your bank app and smile at the lack of transactions.

The Real Cost of Going Zero

So, here we are. After diving into the trenches of the no-spend challenge, what have we really uncovered? Not just the predictable outcome of saving a few bucks, but the unexpected revelation of what truly holds value. When you’re forced to set boundaries (and yes, break them a little), you start seeing your world in a new light. Rules aren’t just guidelines—they’re mirrors reflecting your priorities. And let me tell you, sometimes those reflections aren’t pretty, but they’re honest.

Finding joy in free activities is not just about discovering the local park or dusting off that old board game. It’s about redefining pleasure without a price tag. The real motivation? Not just tracking progress with a spreadsheet, but realizing that life’s richest moments are often those that money can’t buy. So, here’s to the lessons learned, the rules bent, and the moments cherished. Because in the end, the challenge isn’t about spending nothing—it’s about spending wisely on what truly matters.